haven't paid taxes in 10 years

As a general rule there is a ten year statute of limitations on IRS collections. If you dont file your taxes the IRS will often file a Substitution for Return on your behalf.

Haven T Paid Taxes In Years What To Do Farber Tax Solutions

The longer you wait to file your taxes the more penalties you will owe and the likelihood of the CRA seeing your avoidance as tax evasion.

. Print out the forms and take them back to the IRS center. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. In 2002 a consulting firm I.

As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late. You may even get a tax credit out of it all if you werent someones dependent. After this 10-year period or statute of limitations has expired the IRS can no longer try and collect on an IRS balance due.

Once you have all of your taxes filed all eleven years dont forget this years taxes plan ahead to avoid this issue in the future. No matter how long its been get started. Taxes debts more than 10 years old to the IRS can be discharged in a bankruptcy.

Step 1 Check your status with the IRS. The IRS estimates what it thinks you owe. Havent Filed Taxes in 10 Years If You Are Due a Refund.

Can the IRS go back more than 10 years. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. If your behavious has been at the very least.

The debt is wiped from the books by the IRS. The telephone may be the best way since youll often have a. The wage and income transcript has information from Form W-2 and other documents filed about you.

There is a 10-year statute of. When you do get someone on the line ask for the statements for the past 10 years. Youll need wage income return and account transcripts.

Contact the CRA. Those people used to be total aholes but around 10. How many years can I go without paying taxes.

You canand shouldstill file your past three years of tax. The IRS has 10 years to collect taxes that are not paid. Does your tax debt go away after 10 years.

Up until 2002 I was working on contracts as a W2 employee of various consulting firms. Yes there is a statute that limits the collection efforts such as levy of the IRS generally to ten. There will be tax interest and penalties to pay but best to be honest upfront.

If you havent fully paid the tax you can request penalty abatement by sending a letter or through a phone call. This means that the IRS can attempt to collect your. Talk to a tax expert about your withholdings and whether.

You cant seek a refund for the returns that more than three years ago. You can get transcripts of the returns filed with the IRS that you arent able to find. You mention you realised about a year ago that this wasnt being taxed why didnt you do anything.

You only have to go back 10 years because. In 1997 I started working in IT. That said youll want to contact them as soon.

This is because the CRA charges penalties for filing and paying taxes late. For each return that is more than 60 days past its due date they will assess a 135 minimum failure to. If you owed taxes for the years you havent filed the IRS has not forgotten.

In terms of what HMRC can do it has the power to go back up to 20 years to raise assessments and collect the tax on your earnings.

What Happens If I Haven T Filed Taxes In Over Ten Years

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/5DEU3J6QRVDNZGKBAMLR7AR3IE.jpg)

Still Haven T Filed Your Taxes Here S How To Maximize Your Refund And Keep Your Data Safe

:max_bytes(150000):strip_icc()/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png)

What Happens If You Don T File Taxes

I Haven T Filed Income Taxes Will My Personal Injury Claim Be Affected

Never Pay Taxes Again Go Curry Cracker

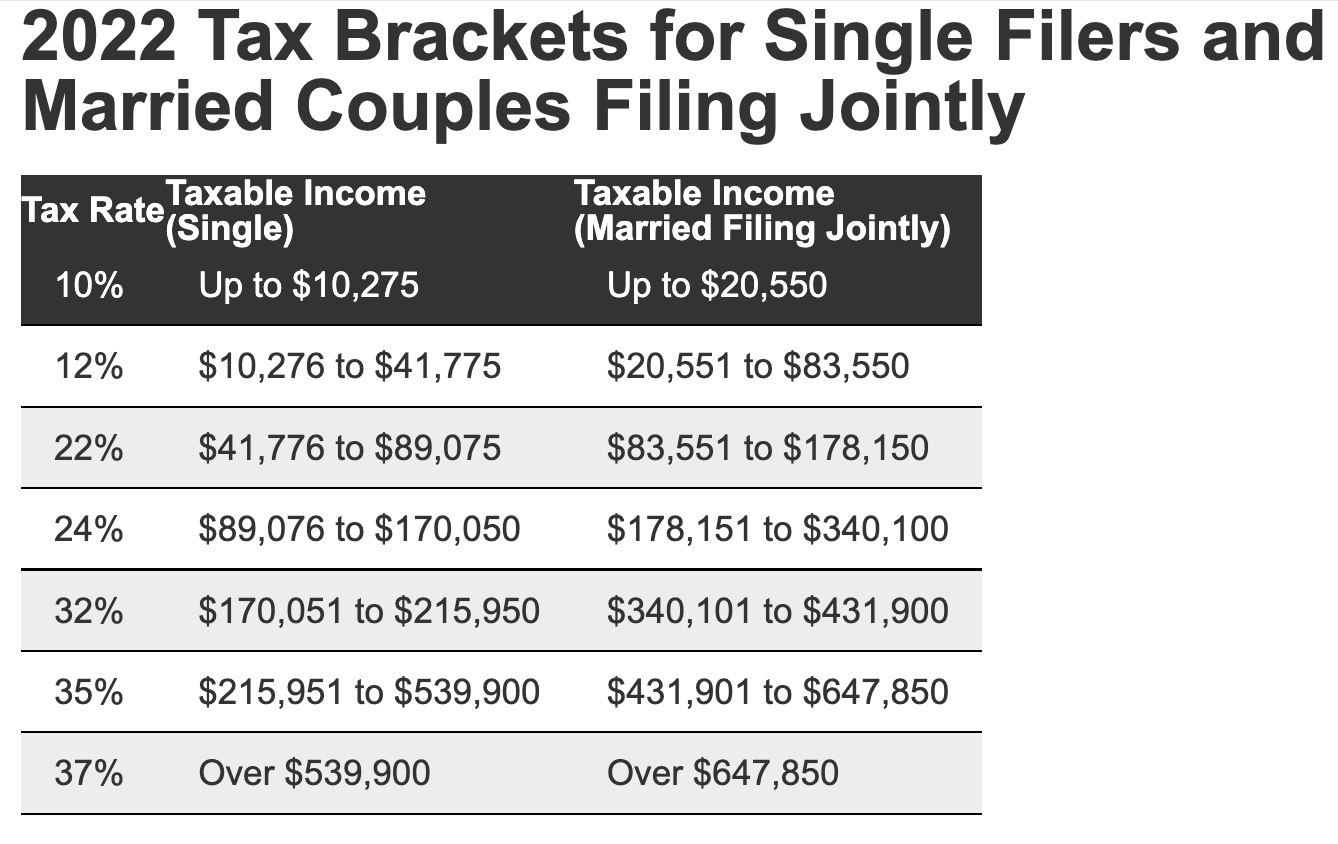

What Are The Income Tax Brackets For 2022 Vs 2021

I Ve Not Done A Tax Return For 20 Years Taxscouts

Not Filed Taxes In Years N Digo

Still Haven T Done Your Taxes How To Get Help

Have You Filed Your Taxes Yet If Not Here Are Tips For Procrastinators Orange County Register

Haven T Filed Your Taxes Yet Don T Worry Capitol Financial Solutions

What Happens If I Haven T Filed Taxes In Over Ten Years

I Haven T Filed Taxes In 10 Years 6 Years Forever Southwest Minneapolis Mn Patch

Tax Tips What To Do If You Haven T Filed Your Taxes Defendernetwork Com

What Do I Do If I Haven T Filed My Taxes In 10 Years

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Haven T Filed Your Taxes Yet You Still Have Time To Get An Extension From The Irs Fl Keys News

Three Quarters Of Americans Haven T Yet Filed Taxes Exact Date You Ll Receive Your Refund If You Still Need To File The Us Sun

What Should You Do If You Haven T Filed Taxes In Years Bc Tax